salt tax limit repeal

Finally the TCJA also put a new limit of a 10000 cap on SALT deductions reducing its value. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break.

. In that case the additional tax may make you able to claim the SALT deduction. As of 2019 the maximum SALT deduction is 10000. After the limit became effective the SALT cost in lost federal revenue was lowered to an estimated 565 billion for FY 2019 and 589 billion for FY 2020 thus resulting in a.

With a slim Democratic majority the 10000 limit was a sticking point in Build Back Better negotiations and House lawmakers in November passed an 80000 SALT cap. However property taxes and income taxes not sales taxes are the primary drivers of the SALT deduction. The TCJA also repealed the Pease limitation for tax years 2018 through 2025.

The chief similarities between the SALT deduction limit and the CTC expansion are that both have run up against President Bidens 400000 pledge and encountered non-trivial. A new bill seeks to repeal the 10000 cap on state and local tax deductions. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Senate Budget Committee chair Bernie Sanders will include a partial repeal of the. Tax code less progressive.

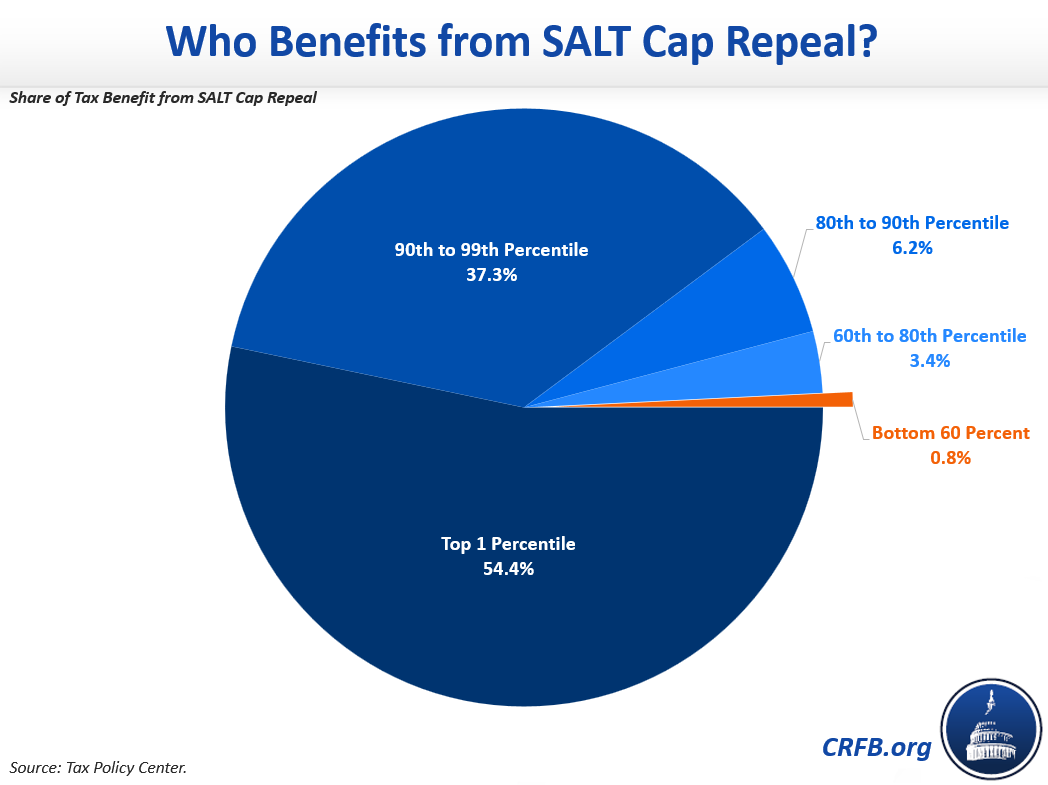

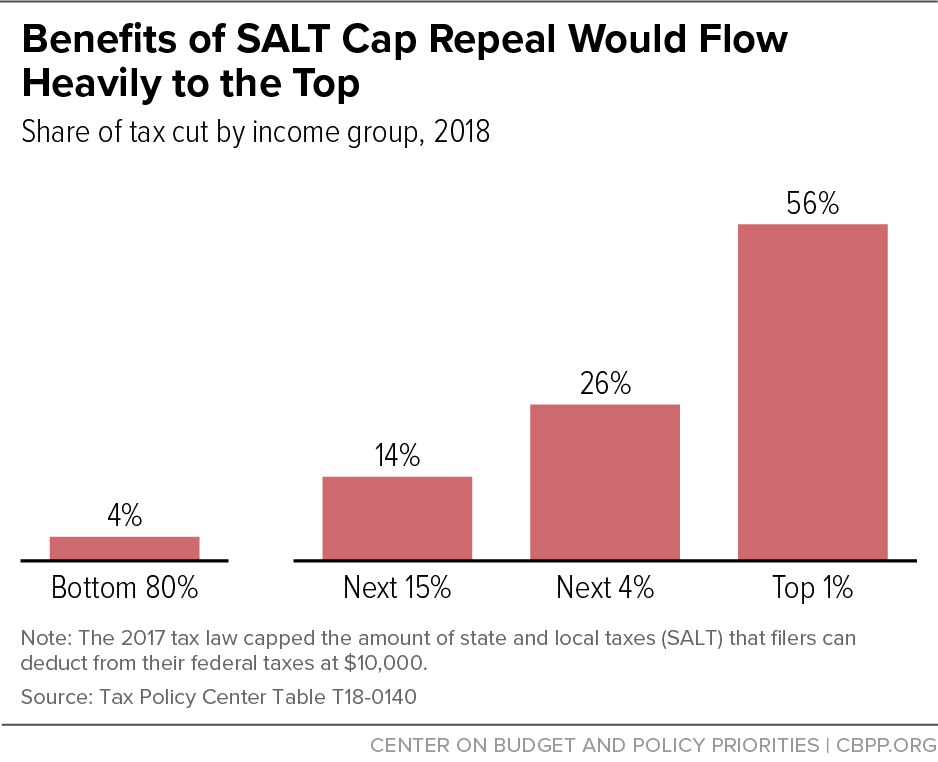

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000. The lawmakers have asked the. June 23 2021 A Move To Limit The Salt Cap Sanders would partially repeal the SALT cap.

D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid. Eliminating the SALT deduction cap as the 116th Congress recently proposed would reduce federal revenue and make the US. But you must itemize in order to deduct state and local taxes on your federal income tax return.

Second the 2017 law capped the SALT deduction at 10000 5000 if. If repealed completely the top 20 of taxpayers may see more than 96 of the relief according to a Tax Policy Center report affecting only 9 of American households. More than 96 percent of the tax cut would go to the highest-income 20 percent of households.

Limit total itemized deductions to 84000 for married taxpayers filing a joint return and 42000 for other taxpayers dollar cap Limit the tax benefit from all itemized. How much is the SALT deduction. The so-called SALT tax.

Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for. August 9 2021 833 AM 3 min read. Starting with the 2018 tax year the maximum SALT deduction.

A growing rift among Democrats over whether to repeal a Trump-era limit on state and local tax deductions is threatening to derail President Biden s 225 trillion tax and. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households. Blue-state Democrats have been fighting since 2017 to repeal a key provision of President Trumps tax plan that penalized high-cost California filers.

The change may be significant for filers who itemize deductions in high-tax. The top 1 percent of households those making 755000 or more would receive.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

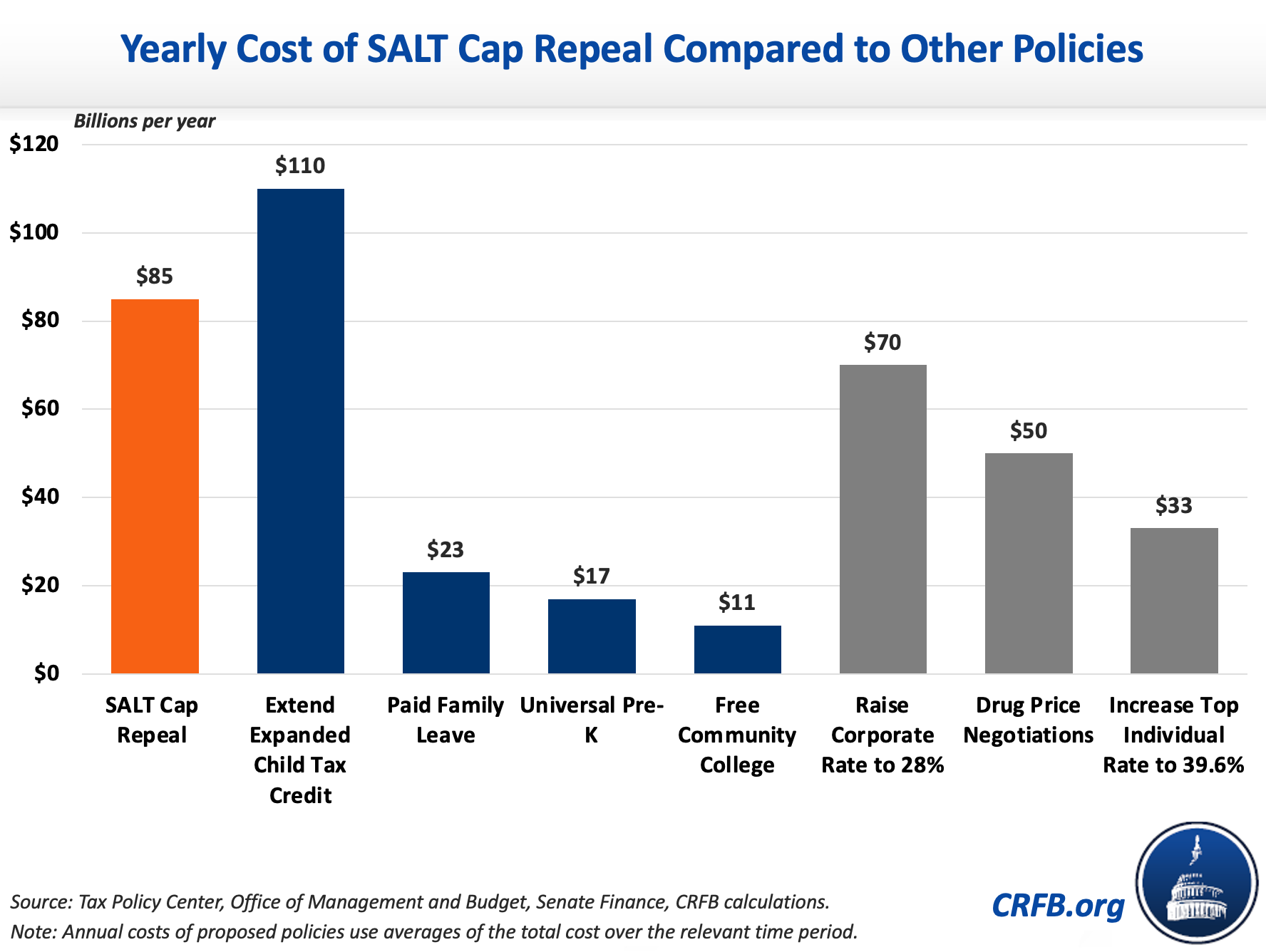

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Salt Deduction Resources Committee For A Responsible Federal Budget

Benefits Of Salt Cap Repeal Would Flow Heavily To The Top Center On Budget And Policy Priorities

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule